ABOUT P2P NOTES

Notes are collateralised

Money invested is backed by a collateral pool maintained to protect the Note holders’ capital. The collateral pool is invested into a diversified portfolio of P2P loans originated by the world’s leading P2P platforms. Symfonie P2P Investments, LLC is a wholly owned subsidiary of Symfonie Capital, LLC. Click here to read about the Symfonie track record.

Your investment professionally managed

When selecting loans for this portfolio we consider not only the absolute level of interest rate, but also fundamentals that underpin credit quality. Our goal is to select loans that offer high interest, but importantly, are likely to be repaid in full and on time.

Built-in buffer helps protects your capital

The Notes pool maintains a reserve that helps ensure Note holder capital is protected. So while an investment in the Notes is not guaranteed, the protection for Note holders is enhanced. We do this by setting aside a portion of the interest pool earns and by supplementing the pool with some of our own capital.

Principal and interest paid quarterly?

Of course! We can arrange to have principal and interest payments delivered to you quarterly. Or, you can reinvest into new P2P notes. The choice is all yours.

Receive regular reports

We want to keep you well informed. You’ll receive portfolio updates throughout the year to let you know how the note pool is performing.

Risk warning: Prior to making any investment in P2P loans investors should ensure they fully understand all the risks of making investments in P2P loans including, but not limited to, the risk that part of all capital invested may be lost. Investors should also consult with their financial, tax and legal advisors. Investing in P2P loans should represent only a portion of an investor’s overall portfolio and does not represent a complete investment program.

Downloads

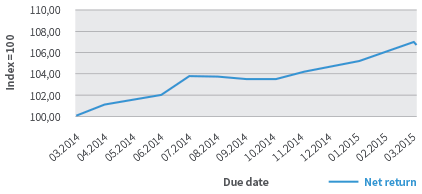

Track Record

- Symfonie Capital, LLC manages a P2P lending fund which invests in four P2P lending platforms with a track record of success. Based on the realised returns of the 3 year and 5 year portfolios of the fund, we offer a classic P2P business loan with interest rates ranging from 6.5% to 10% and maturity ranging from 2 to 5 years.

- Current net return after fees and commissions of the 3 years fund is 6.5 % per annum.

- Current net return after fees and commissions of the 5 yearsfund is 8% per annum.

P2P notes are collateralized by investments in P2P loans issued by leading platforms with track records of success.

Prosper (www.prosper.com) is one of the largest and most reputable sites in the world today. LinkedFinance (www.linkedfinance.com) is the premier site in Ireland dedicated to providing loans to businesses. Bondora (www.bondora.com) is a relatively small lender based in Estonia. Over the past year Bondora has expanded its lending activities and now issues loans in Slovakia, Spain and Finland. SymCredit is one of the first P2P lending platforms in the Czech Republic.

![]()